accumulated earnings tax reasonable business needs

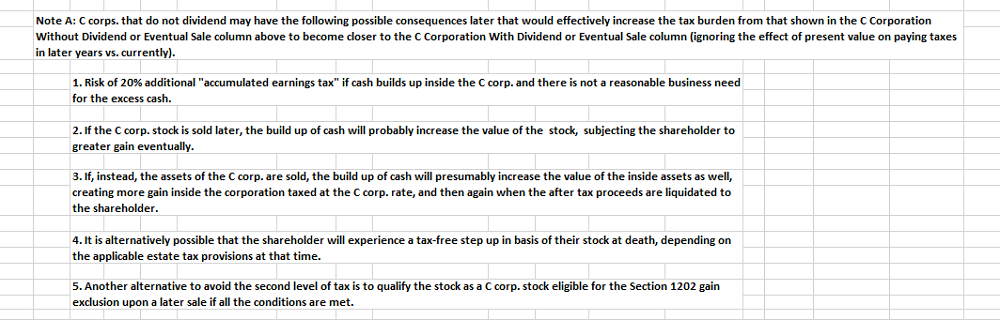

The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. When the PHC tax applies there is.

The Hierarchy Of Tax Preferenced Savings Vehicles

This is a federal tax levied on businesses that are considered invalid and have above-average incomes.

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

. Once again the tax can be levied if the IRS identifies that a corporation is withholding dividends and accumulating earnings for reasons other than reasonable needs. Accumulated Earnings Credit. The issue will be dropped if it is concluded that.

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Get a personalized recommendation tailored to your state and industry. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

In the case of a corporation other than a mere holding or investment company the accumulated earnings credit is an amount equal to such. Ad Find out what tax credits you qualify for and other tax savings opportunities. Tax on Accumulated Earnings.

Essentially the accumulated earnings tax is a. A Proposal articleElliott1970TheAE titleThe Accumulated Earnings Tax and. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the.

Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541. The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. This template calculates the accumulated earnings tax.

However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. This tax is raised and imposed by the IRS whereas the personal holding company tax is basically mechanical.

The accumulated earnings tax imposed by section 531 shall not apply to. The extent to which earnings and profits have been distributed by the corporation may be taken into account in determining whether or not retained earnings and profits exceed the. 1 Accumulated taxable income is.

The PHC tax is self-imposed. This tax was created to discourage companies from. To meet reasonable business needs in order to avoid the individual income tax.

Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline. However this view was apparently not determinative in either case since the. The fact that the earnings and profits of a corporation are permitted to accumulate beyond the reasonable.

Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the Tax.

The accumulated earnings tax. The Tax Code defines. FreshBooks Gives You an Easy Intuitive Accounting Program For Your Small Business Needs.

The Accumulated Earnings Tax and the Reasonable Needs of the Business. The AET is a penalty tax imposed. Reasonable use of accumulated earnings for the purpose of the accumulated earnings tax statute.

For a business to avoid this tax it must demonstrate that the profits carried forward do not exceed the limits of reasonable business needs.

How To Structure A Trading Business For Significant Tax Savings

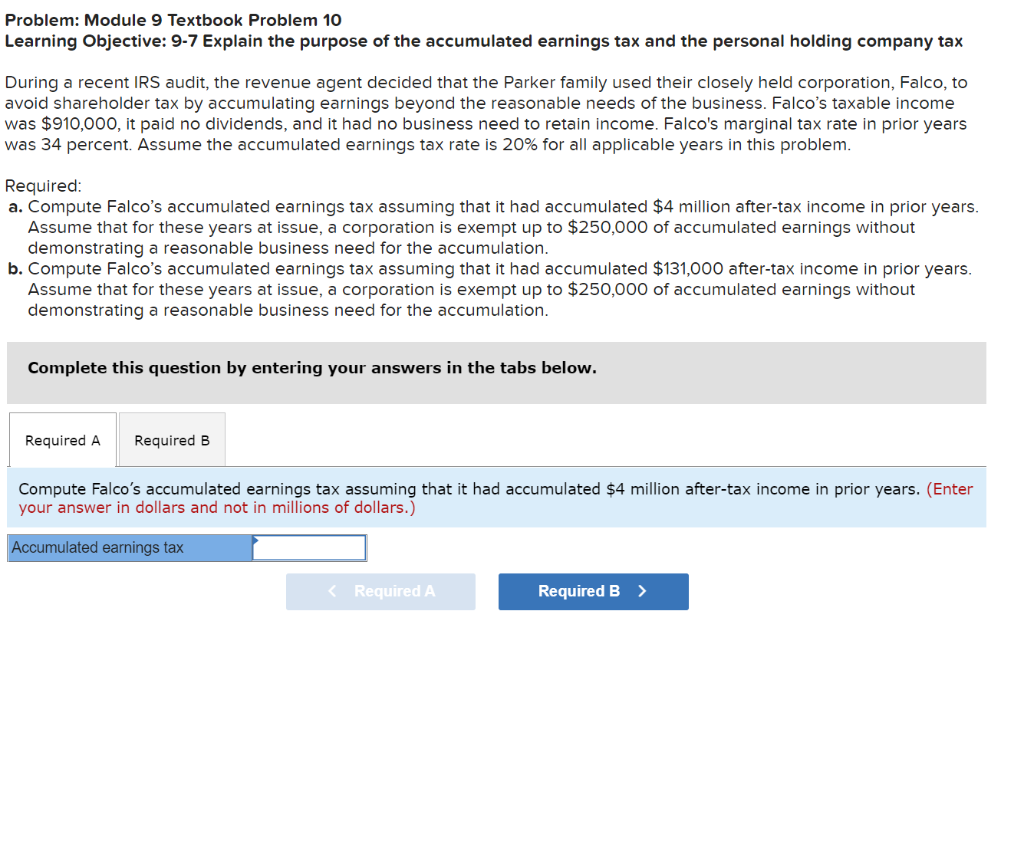

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Qualified Small Business Stock Gets More Attractive

Tax Considerations When Making A Choice Of Entity In Pa

Module 16 Amt And Other Special Corporate Taxes Module Topics N Corporate Alternative Minimum Tax N Personal Holding Company Tax N Accumulated Earnings Ppt Download

S And C Corporations Create Different Tax Consequences Wolters Kluwer

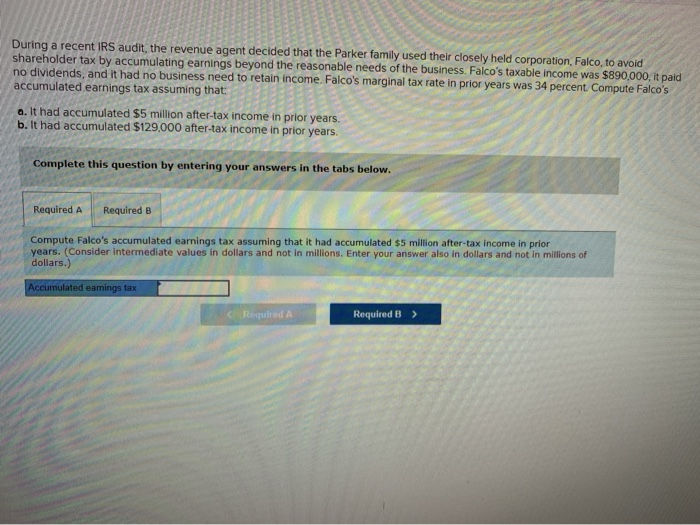

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Answered During A Recent Irs Audit The Revenue Bartleby

What Is Double Taxation A Small Business Guide For C Corps Bench Accounting

A Beginner S Guide To C Corporation Distributions Henssler Financial

Current Developments In S Corporations

Choice Of Entity Considerations Under The Tax Cuts And Jobs Act Forvis

Darkside Of C Corporation Manay Cpa Tax And Accounting

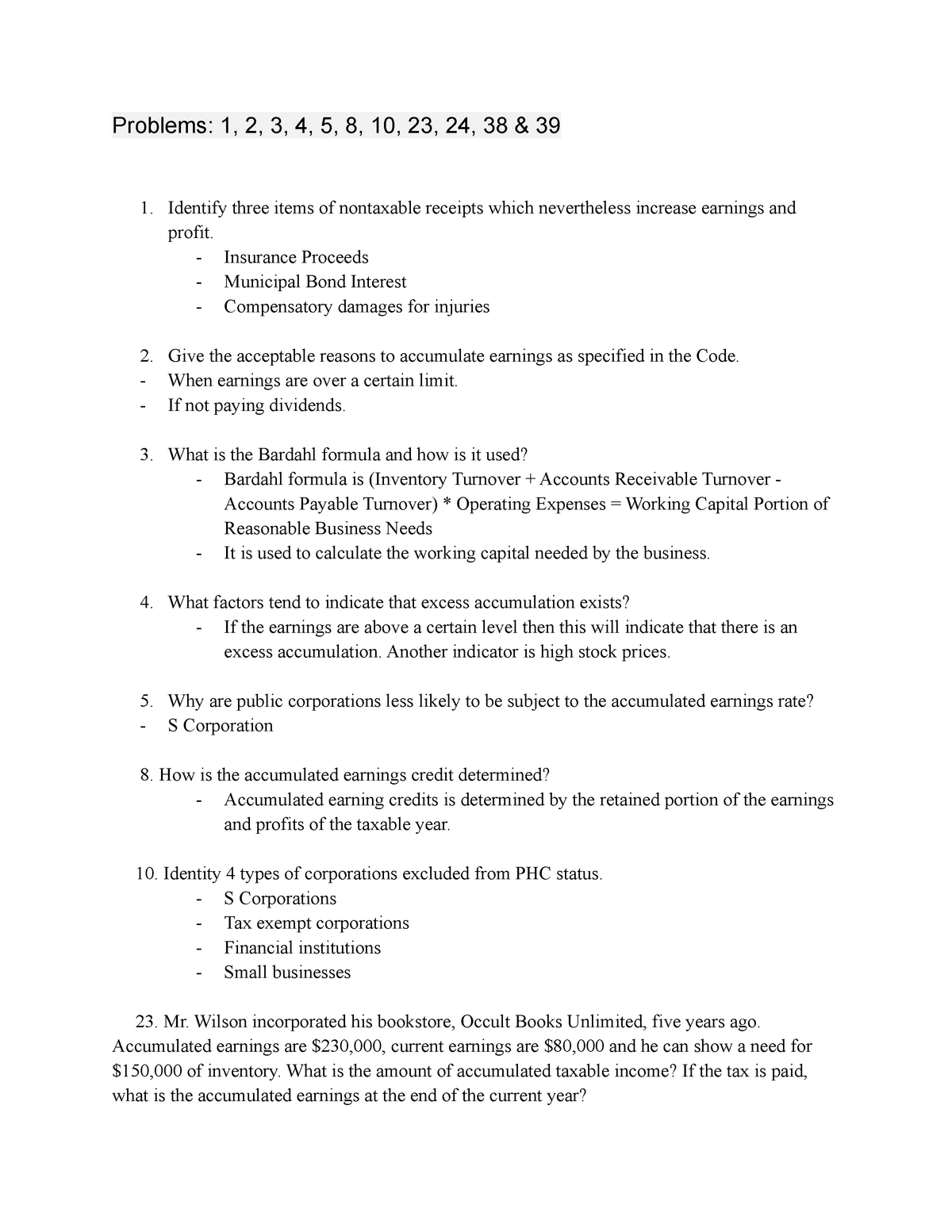

Module 18 Questions Homework Problems 1 2 3 4 5 8 10 23 24 38 Amp 39 Identify Three Studocu

Chapter 12 Key Terms Act 330 Introduction To Taxation Quizzes Business Taxation And Tax Management Docsity

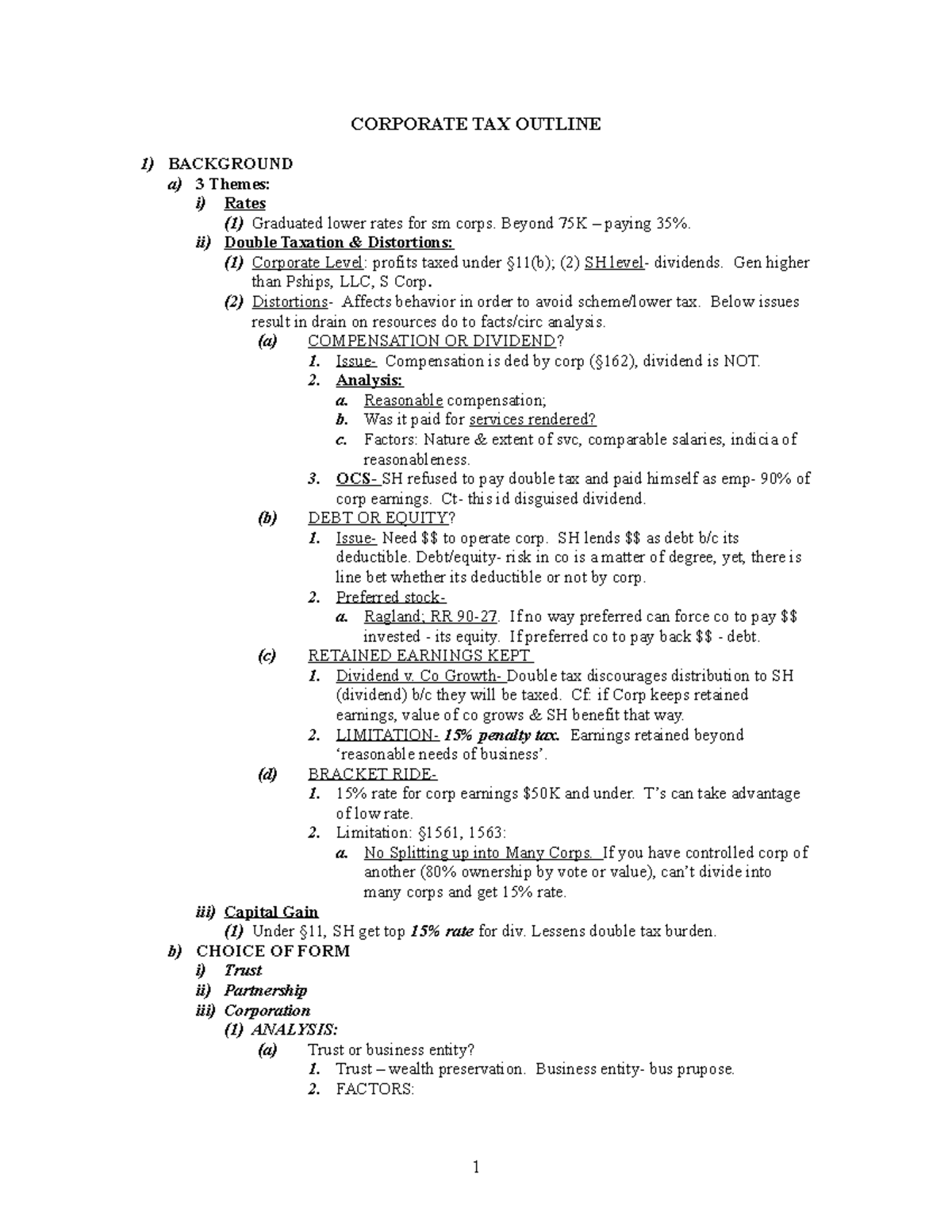

Schmolka F04 Corporate Tax Outline Acct 503 Studocu

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Was Your Ppp Loan Necessary If Not There Could Be Horrific Repercussions